Owning or operating a business can be stressful, especially when it comes to the pressures surrounding money management.

At The ZLC Group, we are committed to your financial health and continued business success. If you are interested in exploring opportunities to relieve some of your business debt, here are a few financial terms and tips to do so:

Debt

Your debt is any amount of money you owe, such as bills, loan repayments, and taxes.

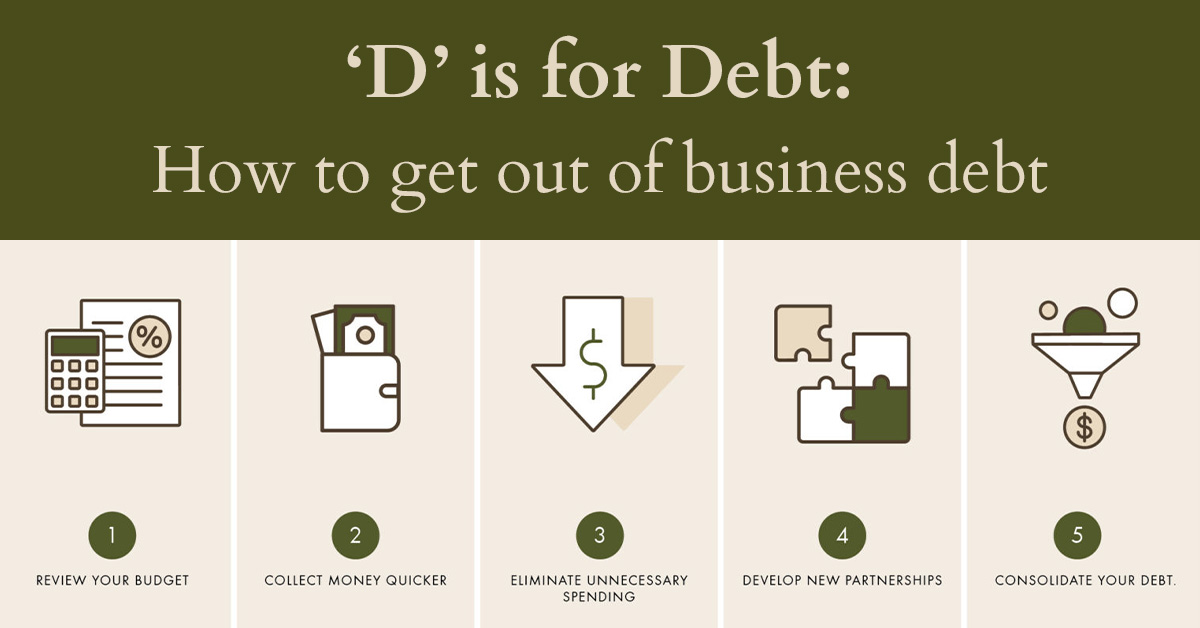

To reduce your debts, you can:

1. Review your budget.

Revenue. Expenses. Profit. There are a lot of ins and outs to your budget. Staying up to date on industry trends, tracking expenses, and following best practices will help you make the best business decisions.

For more on this, please read our blog, “‘B’ is for budget: 3 easy ways to balance your business budget.”

2. Collect money quicker.

Some businesses collect payments upfront or online. But others offer extended opportunities for customers to pay up.

For example, if you offer a 90-day window for customers to pay for your product or service, consider cutting that time in half.

When you revamp your sales protocol so you can collect funds as quickly as possible, you could increase your assets while decreasing your liabilities.

Worth reading: “10 ways to get clients to pay faster”

3. Eliminate unnecessary spending.

Measure your “nice-to-haves” against your “need-to-haves.” If you do not need it, cut it out of your budget.

Also consider shopping around for critical supplies—perhaps there is an untapped opportunity with a new vendor.

And how about managing your most valuable asset: time? You might be surprised how much time (and therefore, money) you could save by restructuring meetings, maximizing route efficiency (for time spent traveling or making deliveries), and managing internal tasks.

Worth reading: “10 ways to cut business costs”

4. Consolidate your debt.

Do you have multiple business loans with various interest rates? It can be difficult to keep track of how much you are paying in interest, especially as interest rates for long-held loans increase over time.

So, the solution is simple: Find a lender that will combine all your loans into a single loan with better terms and conditions, such as a lower interest rate, lower payments, or a shorter repayment period.

Worth reading: “Business Debt Consolidation: How It Works and Best Loan Options”

5. Develop new partnerships.

Is there another business, academic institution, foundation, investor, or philanthropist who shares your mission and vision? Does your business qualify for any grants? When you team up with a like-minded organization, you may find opportunities to share resources, personnel, or marketing opportunities that boost your brand and generate profits.

Worth reading: “The secrets to building better business partnerships”

Debit

A business debit represents two things:

- An increase in your assets, which are what you own (such as cash).

- A decrease in your liabilities, which are what you owe (such as bills).

In this sense, your debit is the opposite of credit, which you can read more about in our blog, “‘C’ is for credit: Finance terms and tips.”

To balance your books, your debits should always match your credits. The closer you are to your ledger, the better you’ll be able to manage your debt.

Other “D” financial terms you should know:

Debt financing – receiving money from a bank or lending institution to improve your business.

Debtor – any entity that owes you money.

Default – a failure to pay a loan or debt.

Depreciation – the process of expensing an asset over a period of time. You can depreciate an asset to spread the cost of the asset over its useful life.

Disbursements – money that your business spends.

Double-entry bookkeeping – a method of bookkeeping where you record each transaction in two accounts: debit on the left and credit on the right.

Drawings – withdrawing money from your business account.

Contact us!

Your business’s books are safe with us. If you’re looking for a helping hand, contact us today.